By Brendan Power

Many of our clients are small-medium businesses (SME’s), but they also have a similar trait – they are tightly-held and/or family businesses. They are surprisingly similar, and an increasing conversation topic has been around the business owner’s succession, and more importantly the ongoing future success of the business.

Challenge

Many of our clients have similar attributes:

Small number of business owners (sometimes just one).

Have been operating for a number of years, generally successful and the business is a large part of their life.

The business is intertwined with family, friends and other investments (eg business premises).

They have a few important senior employees (which may include next generation family) and a small number of key client relationships and referral sources which have all been important drivers to the long-term success of the business.

Most clients want their businesses to succeed into the future and not simply be sold as they are concerned about the well-being of the people and clients they have been working with for a long time.

There have been thoughts of what happens next. You’re enjoying work, and aren’t sure what retirement (or succession) looks like.

Solution

Luck rarely plays a part in succession. Planning is important, often long term, and if you try and fast-track retirement/succession you will often have employees/clients concerned about their own future.

However, the important factors are normally staring you in the face. You need to take your key employees, key clients and key referral partners on a journey… and it takes time.

Most business owners often initially think that retirement/succession means leaving on Friday and not coming back Monday. However, we are finding that more business owners want to reduce their involvement but not necessarily cease working completely (because they enjoy it and care about the future success of the business). This has the following outcomes:

By reducing both hours and ownership over time, this gradual transition to the next generation provides huge comfort to them as you are still available to help with the big deals and decisions, as well as reducing the changeover with continuing clients and referral partners.

Allows you to take on a more managerial role and assist the next generation with their transition to business owners.

There is a need for you to be flexible as the next generation will want to implement changes.

Outcome

It is important to approach succession with a win-win mindset.

We often point out to clients, the most valuable “earn” from their business is the annual profits, not necessarily the sale of the business at the end… This is in fact often the cream. However, by remaining as a business owner for longer during the succession to the next generation can be can be very rewarding and reduce stress on both yourself as you exit the business over time, and the incoming business owner as they learn the ropes.

How can we help?

The type of discussions and assistance we often have with clients includes:

Identifying those key people in the business, and assisting with early discussions so they know there is a future and pathway for them to continue.

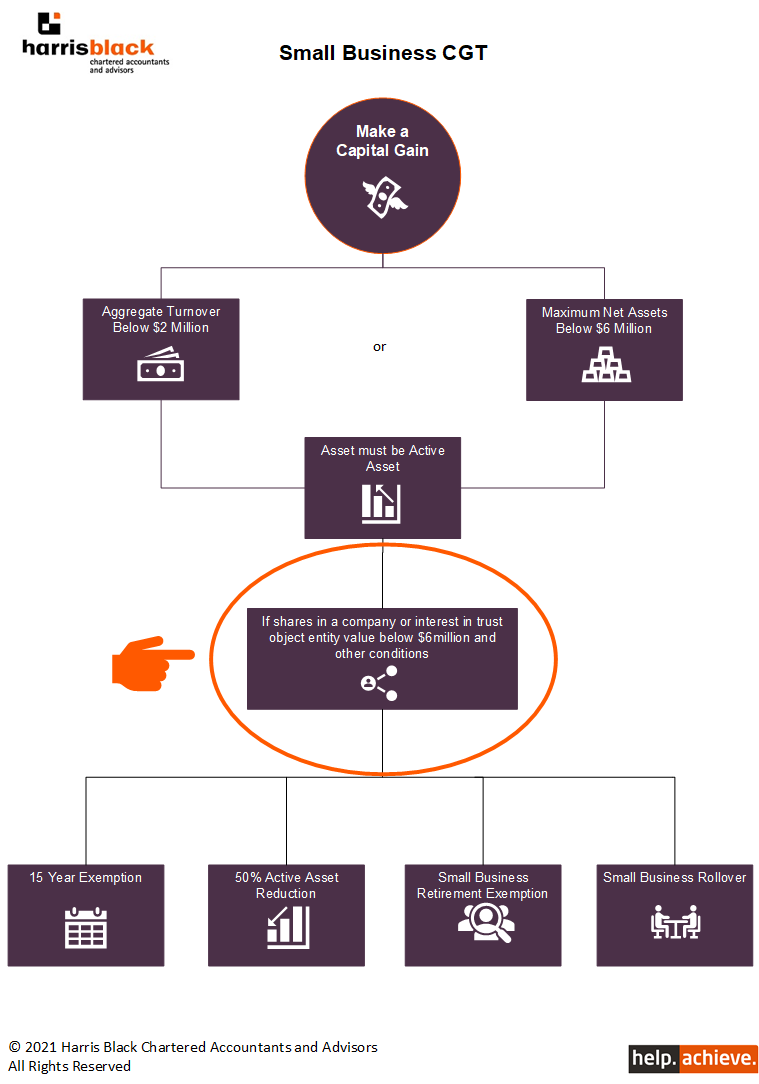

The importance of the correct structure, both for:

– the actual business – the wrong structure can be detrimental to the introduction of new owners; and

– the actual shareholder/owner – for both distribution of profits and capital gains implications upon sale.

Appropriate pay structure for current owners (this is often overlooked or below market).

Ensuring an appropriate shareholders agreement is in place.