2022 will be a year full of opportunities for many business leaders as they leverage the lessons learned from the last two years as part of a strategic reset for the year ahead.

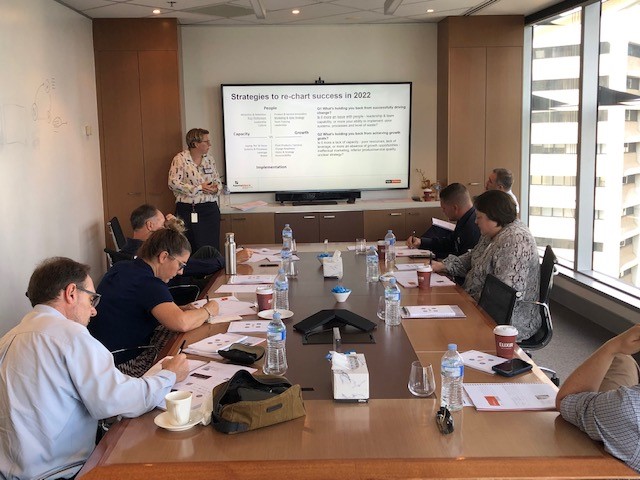

In our recent workshop for the Harris Black Business Leaders Forum, we looked at ‘Leveraged Leadership – Resetting your strategies for 2022’.

This theme had us discussing emerging leadership trends, sharing day-to-day best practice with each other and developing practical strategies to guide improved decision making and success.

Discussed on the day:

Emerging leadership trends for 2022

Leveraged leadership – how to reset yourself to better capture opportunities

Making tough decisions faster as a leader

Coaching your team to lift their capabilities

Overall, it was a great session and attendees walked away with clarity on practical ways they can leverage themselves more effectively in 2022 and some clear action items.

If you are interested in joining our Business Leaders Forum to gain exposure to practical and high-value learning sessions and discussions with other business leaders, then please contact your Harris Black team member.