As we close the chapter on an extraordinary 2025, let’s celebrate the milestones, achievements, and unforgettable moments that made this year remarkable.

Here’s to new opportunities, continued success, and an amazing year ahead!

Author: Harris Black

Business Health Check

Is Your Business Thriving – or Just Surviving?

When was the last time you truly assessed the health of your business? If you’re feeling stuck or unsure where to focus your efforts, you’re not alone. Too often, business owners wait for the “right time” to review performance—only to see valuable opportunities slip away while growth and profit stagnate.

At Harris Black, we make it simple and productive to take control of your business’s future.

Watch the below short video from Keziah Sedgwick, Principal, as she discusses how we can help you with your journey through our Business Health Check.

A Tailored Approach for Maximum Impact

Before your session, you’ll complete a specialized online diagnostic tool that provides valuable insights into your business. Whether it’s performance, change readiness, sales, resilience, or leadership, we customize the health check to focus on what matters most to you.

What You’ll Walk Away With

A clear understanding of your current business performance

Key areas of focus to drive growth and profitability

A personalized action plan with practical next steps

Take Action Today

Don’t let another year pass without taking charge of your business’s success.

Contact your Harris Black team member to book your Business Health Check today and gain the clarity, confidence, and strategy you need to achieve your goals.

RECAP: Harris Black Business Leaders Forum – November 2025

In our recent Harris Black Business Leaders Forum (BLF), we looked at ‘AI won’t lead your people: How to build a high performing culture in an era of AI disruption’.

As AI continues to transform how we work, one message stood out: it’s not algorithms but culture and leadership that drive lasting success.

Participants explored the shifting responsibilities of leaders in an AI-enabled world, debated future-of-work trends like generational change, work-life integration, and AI-driven productivity, and shared real-world examples of how to strengthen culture and talent.

Everyone walked away with practical tools and strategies to future-proof their people and position their organisations as destination employers heading into 2026.

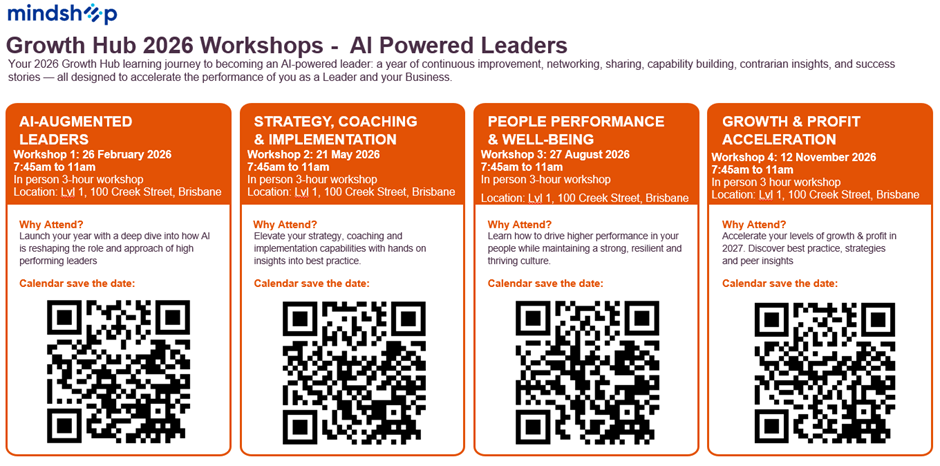

If you are interested in joining our practical and high-value learning workshops, we would like to invite you to join us at the next BLF on 26 February 2026. Please contact your Harris Black team member to register your interest.

Scan the QR code to save the dates for our 2026 workshops.

Brentnalls National Conference October 2025

Last month, Directors, Principals and Practice Managers from our Brentnalls Affiliates gathered in Adelaide for our bi-annual national conference – a chance to reconnect, share ideas, and look ahead together.

Day 1: Getting Started & Catching Up

We kicked things off at Brentnalls SA’s new office in Hindmarsh, where Practice Managers met to discuss current challenges and opportunities. Afterwards, everyone enjoyed a tour of the new space and some welcome drinks. The evening wrapped up with a lively cocktail party at Electra House, giving everyone a chance to catch up before the conference officially kicks off.

Day 2: Strategy, Updates, and New Ideas

Thursday’s sessions at the Marriott Hotel started with a welcome and a quick update on our group’s strategy. We revisited the history of Brentnalls’ national affiliation and set the tone for the day.

Some standout moments:

- Industry Update: Justin Porch shared what’s new in the accounting world.

- Practice Updates: OHM and Brentnalls NSW talked about what’s working in their firms.

- Next Gen Talent: Warwick Cavell led a discussion on attracting and keeping great people, including pathways to equity.

- Benchmarking: Wade Crane helped us dig into performance data and best practices.

- Tech & Compliance: Peter DiStefano from BGL showed off new tools for client verification and automation, especially in light of AUSTRAC’s latest requirements.

We also broke out into office groups to talk through learnings and action items, enjoyed lunch together, and ended the day with dinner at Fugazzi.

Day 3: HR, More Updates, and Action Plans

Friday started with practice updates from Brentnalls WA, Harris Black, and Chester Grey. Naomi Wilson from Focus HR gave a practical session on HR risks and how to handle them.

Other key activities:

- Each firm worked together to list out action items and outcomes from the conference.

- Subcommittees gave quick updates on tax, business advisory, next gen initiatives, women in Brentnalls, and AI.

- The conference wrapped up with dinner at Ocean Bar and Kitchen on Henley Beach—a great way to finish up and celebrate our shared achievements.

Looking Forward

This year’s Brentnalls conference was all about learning from each other, sharing what works, and planning for the future. With a focus on innovation, benchmarking, and developing our teams, we’re set to keep moving forward together and look forward to gathering again in Perth in March 2026.

Meet The Staff – Sam Caprioli

This month we’re excited to welcome Sam, who joins us with an impressive mix of academic achievement and sporting experience — including a high ATAR and three years in the Brisbane Lions Academy. When he’s not working or studying, you’ll likely find him DJing, watching sport, or cooking up a burrito bowl or his signature spaghetti and meatballs.

Sam’s love of good food runs deep. His deserted-island essentials include water, lasagna and an AFL footy, and if he had to choose one meal for life, Nonna’s spaghetti and meatballs would win every time. He also swears by his morning ritual: a homemade double-shot latte to kick-start the day.

Fun fact: athletic talent runs in the family — Sam’s cousin is the personal trainer for NBA star Luka Dončić. With sport, music and food all playing a big part in his life, Sam brings a lively and well-rounded energy to the office.

We’re thrilled to have him on board and look forward to working with him.

Important Tax Dates

1 December 2025

- Pay income tax for taxable large and medium taxpayers, companies and super funds. Lodgment of return is due 31 January 2026.

- Pay income tax for the taxable head company of a consolidated group with a member deemed to be a large or medium taxpayer in the latest year lodged. Lodgment of return is due 31 January 2026.

- Pay income tax for companies and super funds when lodgment of the tax return was due 31 October 2025.

21 December 2025

- Lodge and pay November 2025 monthly business activity statement.

21 January 2026

- Lodge and pay quarter 2, 2025–26 PAYG instalment activity statement for head companies of consolidated groups

- Lodge and pay December 2025 monthly business activity statement except for business clients with up to $10 million turnover who report GST monthly and lodge electronically.

31 January 2026

- Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in quarter 2, 2025–26.

- Lodge tax return for taxable large and medium entities as per the latest year lodged (all entities other than individuals), unless required earlier.