By Grace Wong

COVID-19 has affected many aspects of our daily lives however employers may not have thought about the impact on their fringe benefits tax (FBT) liability for the FBT year ended 31 March 2021.

FBT is a tax employers pay on certain benefits they provide directly or indirectly to their employees, including their employees’ family or other associates.

We have summarized below three common FBT exposure areas impacted by COVID-19.

1. Working from home office equipment

Many employers provided their employees with office equipment (e.g. desk, office chair or other equipment that is not a portable electronic device) to promote a smooth transition to working from home.

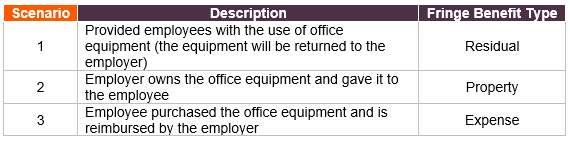

The FBT exposure depends on how the benefit was provided:

The key difference between (1) and (2) is that the employee returned or will return the equipment to the employer in (1) whereas in (2) the employee keeps the equipment.

Exemptions & Reductions

If an exemption or reduction applies to a fringe benefit, the taxable value of the benefit is reduced by the exempt amount or reduction amount.

If (1) applies, the employer may consider the section 47(3) exemption from the Fringe Benefits Tax Assessment Act 1986: regarding a residual benefit that consists of the use of property that is ordinarily located on business premises and used in connection with business operations. This exemption does not apply to (2) or (3).

For all scenarios above the employer may consider the minor benefits exemption or the otherwise deductible rule. However, under (2) and (3) these exemptions are limited due to:

Minor benefits exemption – cost of the equipment must be less than $300 including GST (whereas under (1) the use of the asset must be equal to less than $300 including GST); and

The Otherwise Deductible rule can only apply if the employee could have claimed an immediate tax deduction for the equipment (rather than depreciation over time) in their personal tax return

2. Cancelled staff functions

Due to COVID-19 some staff functions, for example end of financial year parties, did not go ahead as planned.

However, there is no FBT exposure in relation to non-refundable deposits for staff functions that were later cancelled as:

the transaction was between the employer and the venue (not employees); and

staff did not attend the event therefore no fringe benefit was provided.

Ordinarily entertainment expenses are non-deductible, and the associated GST non-claimable, unless the expense was subject to FBT. Unfortunately, non-refundable deposits for staff functions are still considered to be entertainment expenditure. This means employers cannot claim income tax deductions and GST credits for non-refundable deposits.

3. Employer-provided cars garaged at employees’ homes

When an employer-provided car is parked at an employee’s home, generally the car is considered to be available for private use. This constitutes a car fringe benefit.

The ATO have provided an exemption for cars garaged at employees’ homes due to COVID-19, provided the following conditions are satisfied:

the operating cost (logbook) method is used to value car fringe benefits;

the employer must elect in writing to use this method (rather than the default statutory method);

the car must have been garaged at the employee’s home during the FBT year; and

while the car was garaged at home, it was not driven or it was driven briefly only to maintain the car.

Applying the exemption will result in the number of days available for private use being reduced and therefore a lower taxable fringe benefit for the employer.